Luckin Coffee: Recent Selloff, F&B Spending and Relisting

F&B Spending a Bright Spot

Over the past three and half months, both Luckin Coffee (LKNCY) and Yum China Holdings (YUMC) lost more than one third of its market capitalization while S&P 500 Index (SPY) was up 10% during the same period (see chart below). The severe selloff was largely due to the market concerns over the struggling China economy, especially the weakening consumer spending.

Source: Seeking Alpha.

All these concerns are legitimate as the recently released China’s macroeconomic data indeed painted a dismal picture (see charts below).

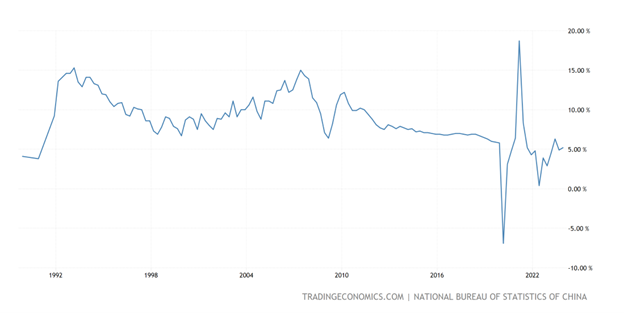

China GDP Growth Rate

China Consumer Confidence Index

China Retail Sales MoM Changes

Food Inflation

However, contrary to the trends illustrated above, month over month growth rate of food and beverage (F&B) spending in China has been very strong throughout 2023. National Bureau of Statistics of China (NBS) breaks down the retail sales of consumer goods into 18 categories and releases data on monthly basis. Restaurant spending, i.e. F&B spending is one of those 18 categories.

We generated the following chart using NBS data to compare the growth rate of total retail sales of consumer goods and F&B spending. The trend is very clear that F&B spending declined significantly and underperformed total retail sales growth in 2021 and 2022 due to COVID as most of the restaurants were closed during the lockdowns. The trend in 2023 was exactly the opposite as F&B spending registered robust and consistent growth and outperformed the total retail sales the entire year.

China Restaurant Spending vs Total Retail Spending Changes (YoY)

Source: NBS data.

NBS does not provide further breakdown by sub sectors, such as full dining or quick service or coffee chains, but we think that LKNCY should have benefited from this trend during an economic downturn given its business model of providing quality coffee at discounted price.

Relisting Likely Back on Top of LKNCY’s Priority List

Per the disclosure in LKNCY’s annual report of 2022, Centurium Capital, a leading private equity firm in China, is the controlling shareholder of the company with an aggregate voting power of 55.7% through its ownership of Class A, Class B ordinary shares and senior preferred shares (see table below).

Source: Company filings.

The sharp correction since mid October 2023 could be a timely wakeup call for both Centurium Capital and the company management for the following reasons:

1) The selloff should have cost Centurium Capital a big chunk of its performance fees in 2023. LKNCY stock was up 51.8% as of mid October 2023 before nosediving 41.6% in the last two and half months of 2023. As a private equity firm, Centurium Capital should charge a standard 2/20 fee. With that 41.56% drop, it should have lost $8.3 million fee income for every $100 million it invested in LKNCY.

Source: Seeking Alpha.

2) Lack of liquidity of OTC market could have exacerbated the downward spiral during this wave of selloff. One major issue of OTC is its lack of liquidity and participation of large institutional investors. Consequently, a small number of shares could create sharp stock price swings. For LKNCY, even if its valuation is getting more and more appealing after the recent price correction, a lot of institutional investors still could not step in as their mandates do not allow investment in OTC stocks. This can be easily seen by comparing the shareholders lists of LKNCY and YUMC below. The rosters of institutional investors are quite different between the two, obviously YUMC has a more diverse and more “famous” investor base (see screenshots below).

LKNCY’s Institutional Holders List

YUMC’s Institutional Holders List

A relisting on a major exchange will immediately expand LKNCY’s investor base which can provide much needed support for LKNCY’s stock price during an unwarranted selloff. Since the company completed its restructuring, relist was not high on its controlling shareholder’s priority list. Now it is time to change.