LKNCY Stock Up 40.9% YTD 2023

Luckin Coffee Inc. (LKNCY) outshined both its industry peers and the broad market indices year to date 2023. As of October 13, 2023, LKNCY was up 40.9%, leading S&P Index (SPY) by 27 percentage points and handily outperforming Yum China Holdings (YUMC), Starbucks Corp (SBUX) and Global X MSCI China Consumer Discretionary ETF (CHIQ) by a significant margin (see chart below).

LKNCY vs SPY, CHIQ, SBUX and YUMC

More importantly, LKNCY achieved this impressive performance while the markets were generally concerned about the weakening economy and heightened geopolitical uncertainties in China. The negative market sentiment against China was fully captured by the iShares MSCI China Index ETF (MCHI) which underperformed the iShares MSCI World Index ETF (URTH) and the S&P 500 ETF (SPY) by 22 percentage points and 24 percentage points respectively (see chart below).

Our investment thesis remains unchanged that LKNCY stock price could have 3x to 5x upside from its level in April 2022 and an imminent relisting onto the main exchange will be the key catalyst to unlock the move. Additionally, with the ever improving fundamentals as well as the accelerated pace of store openings in China and overseas, investors could continue to be surprised to the upside during 2023.

Total Store Count Reached 12,795 in 3Q 2023

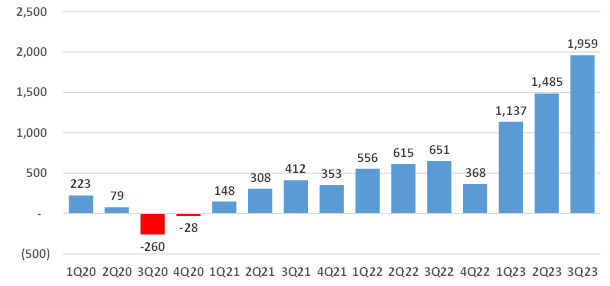

Based on the weekly updates from its wechat channel, LKNCY opened approximately 1,959 new stores in China and Singapore during 3Q 2023 (see charts below) and reached a total store count of approximately 12,795. At this speed, LKNCY should be able to operate close to 14,000 stores by year end 2023 and surpass 15,000 stores during the first quarter of 2024.

Luckin Coffee Quarterly New Store Openings

Luckin Coffee Quarter End Store Count

At the end of 2Q 2023, the company’s self-operated stores accounted for 66% of total store count while the partnership stores (i.e. franchised stores) accounted for 34%. Over the past three years, the share of the partnership stores had steadily increased from 10% in 1Q 2020 to over 34% (see chart below) in 2Q 2023. This trend should continue in both 3Q and 4Q 2023 as the company started to harvest the benefits of its partnership store campaign at 80 cities in 15 provinces in China early this year.

Partnership Stores as % of Total Stores

Among the new stores opened during 2Q 2023, 59% were self-operated stores while 41% were partnership stores. However, the partnership stores cover a significantly larger number of cities in China (see chart below).

Self-Operated vs Partnership Stores: Number of Cities Covered

The reason that the self-operated stores have higher store count in much less serviced cities is the store density. The self-operated stores are mainly in first and second tier cities, averaging 101 stores per city while partnership stores are in lower tiered cities with only 14 stores per city on average. However, it also means that there will be significant room for the partnership stores to grow.

Pace of New Store Openings Hit Historic High (again) during 3Q 2023

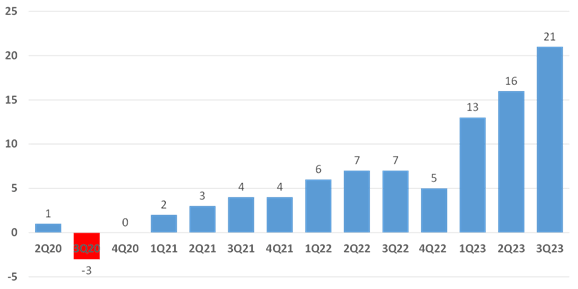

The average new store openings per day is the key metric to measure LKNCY’s pace of opening new stores. As illustrated in the chart below, the pace of new store opening during the third quarter 2023 reached a new historic high of 21 stores per day, up from the previous high of 16 in 2Q 2023 and more than tripled the full year average of 6.4 per day in 2022.

Average New Store Openings per Day 3Q 2023

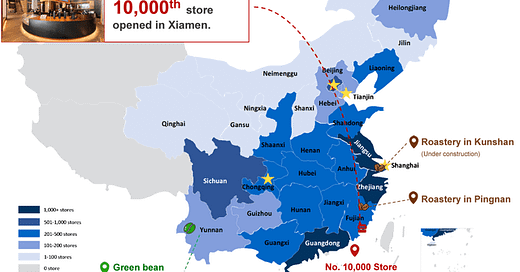

New Store Openings on the Map

LKNCY updated the store map in its 2Q 2023 earnings presentation, and we added an overlay of new store openings data for 3Q 2023 (store count in each province highlighted in red).

New Store Openings in 3Q 2023

The growth trends are consistent with what we observed in 1Q and 2Q 2023. The expansion continued to be density focused with six high density provinces (Jiangsu, Zhejiang, Guangdong, Sichuan, Hubei and Fujian) each opening at least one store per day during 3Q 2023. LKNCY currently operates stores in 29 provinces and direct municipalities in China, these top six provinces accounted for 47% of the new stores opened during the quarter while the rest of 23 provinces accounted for 53%.

Singapore Expansion

LKNCY opened additional 10 new stores since end of July and is currently operating a total of 20 stores in Singapore. It seems that the company is targeting to open 4-5 new stores per month.

We also track the download number of Luckin Coffee’s mobile app (Singapore version) to assess the size of the company’s client base in Singapore because LKNCY’s mobile app centric business model makes the download number (i.e. the registered or activated users) a very good proxy for the customer counts.

LKNCY Android App Download Count

As of October 16, 2023, the android version of Luckin Singapore app was downloaded more than 100,000 times from Google Play, doubling the count we observed in July (see chart above). In order to calculate the total number of mobile apps download (both Android and iOS), we have to make a reasonable assumption on iOS users as Apple app store does not disclose the download number. According to the market data company “Statcounter”, 71% of mobile phone users in Singapore used Android operating systems in 2023 while 29% used Apple iOS. This implies that the total download number of Luckin Singapore app, i.e. activated client count, could be around 140,000 (100,000 divided by 71%), which is about 2.5% of Singapore population (5.5 million) or an average of around 7,368 clients per store.

Obviously, it is still too early to judge how successful the company is in Singapore given the short operating history. We would hope that LKNCY could provide some level of updates about the international operations in its 3Q 2023 earnings in November.

Great post